In summary, we recommend starting your company as a DAO controlled by workers. Then, when you're ready for more complex operations like fundraising or filing taxes, you should pair this structure with a traditional legal entity, such as a corporation.

In this structure, every worker receives a DAO token that gives them an equal vote, but no right to future profits. Investors, founders, and early employees can be issued equity in the corporation, entitling them to a share of future dividends but no voting rights.

Company Structure

A DAO (decentralized autonomous organization) is a community whose central operations are determined democratically on the blockchain. This generally includes top-level decisions like selecting board members or approving a CEO.

The power of a DAO lies in two unique features. First, it allows you to keep your organization's treasury (your core funds, to be allocated into individual accounts for day-to-day use) on the blockchain, as a cryptocurrency like Ether or Bitcoin. Second, it allows you to use the blockchain to give workers a democratic voice in setting the company's direction.

Some organizations choose to use only this DAO, without a corresponding legal entity. But companies that need limited liability, outside equity, or other benefits of incorporation can use a DAO embedded within a corporate structure. More information on how this option works can be found below, in The Corporation.

The DAO

A DAO lets you restrict company funds so that they can be used only with authorization from a majority of your workers. This is implemented by giving each employee a unique token which they control and which gives them an equal vote on these decisions. You don't need to hold a vote every single time money is used; with tools like those below, workers can delegate their vote to whichever leaders they believe should have that authority.

With this set-up, you can ensure that your organization is not only democratic, but fundamentally and irrevocably so. It becomes impossible to move that capital without the consent of the workers, even with the full force of investors, world governments, or you yourself. That's what makes the organizations truly decentralized and autonomous, securing the full trust of your employees.

The Corporation

While a DAO provides a great way to design the practical operations of your organization, you'll eventually need some kind of formal legal structure. While some DAOs operate without this, a corporation provides key advantages, like limited liability, easy tax filing, and simpler investment. The last part is especially important: incorporating the DAO model within a legal corporate structure will let you issue equity or promises of future equity as start-ups typically do, except that these will come with rights to future dividends but not to vote in board elections.

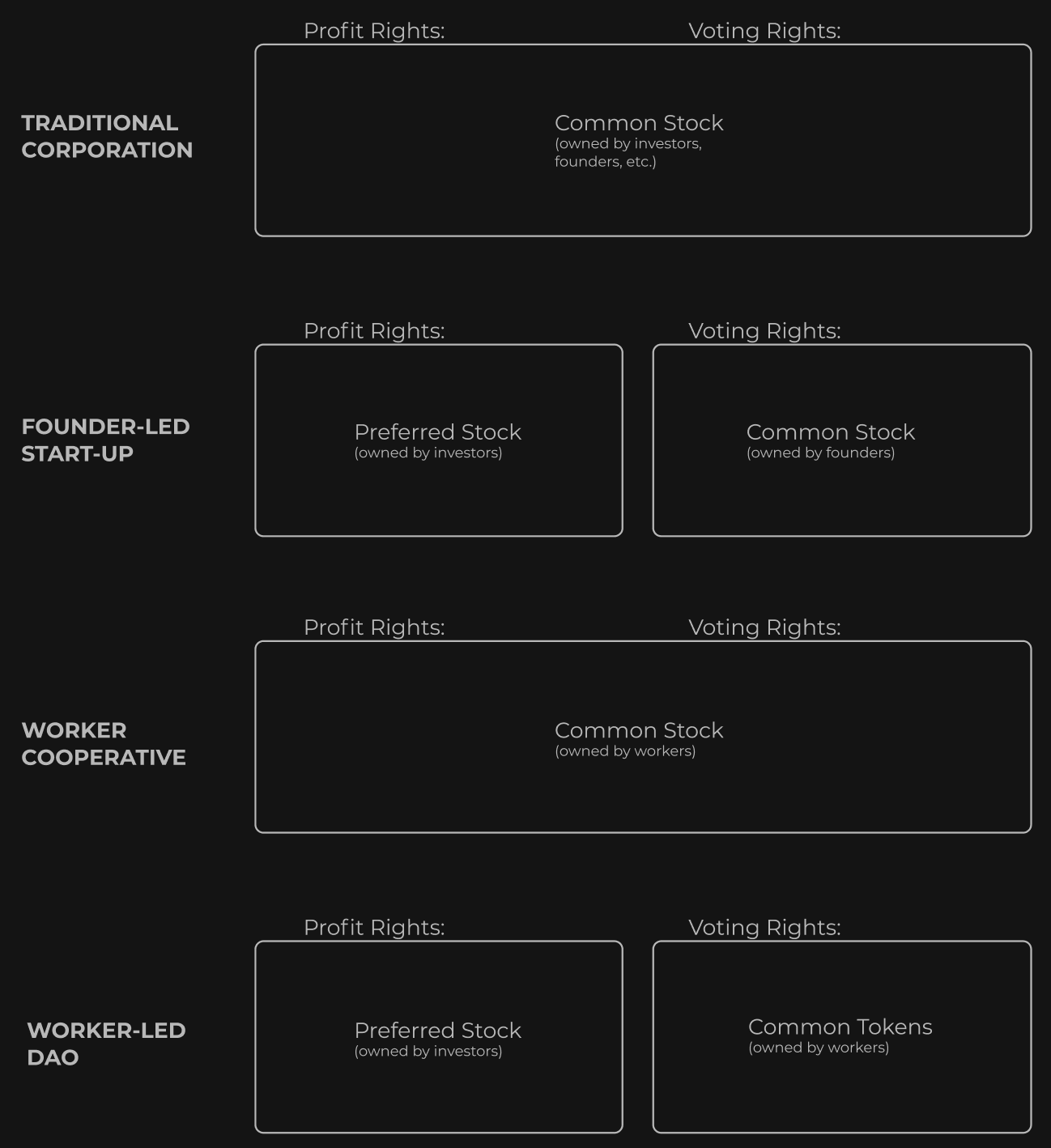

What you're essentially doing is dividing the typical rights of company ownership into two parts: rights to vote on major decisions and rights to future profits. In a traditional corporation, both of these are reserved for shareholders (typically investors, with a minority stake for founders). In a traditional worker co-op or a worker-led DAO without an associated corporate entity, they're both reserved for workers.

But crucially, founder-led start-ups have made it common to split these rights; in that case, the company gives voting rights exclusively to founders (as “common stock”) while still issuing profit rights to investors (as “preferred stock”), without any meaningful voting rights. By chartering a corporation to house your DAO, you create a similarly split structure: decisions are still made by token-holders in the DAO, but you can issue preferred stock (with profit but not voting rights) to investors.

Setting Up This Structure

If you are interested in setting up a corporation associated with your DAO, you should consult with an attorney about when to establish this structure and what entity to choose. A typical time to make this decision is when you take on your first round of institutional investment. Setting up this entity will help you use the documentation typically favored by VCs, like the SAFE; you'll need to hire legal assistance at this stage, either way.

We recommend proposing a standard corporation with the DAO integrated into the by-laws. You'll want to ensure that control is specifically reserved to the DAO and the workers it represents, probably by issuing special common stock with no right to a share of dividends. Preferred stock can be issued to founders, investors, and early employees as usual, but with no voting rights.

If you have already chartered a corporation, you can still establish a DAO and amend your by-laws to give it control over governance. You'll need approval from a majority of existing shareholders to make this change, and you will of course need to consult your attorney on the details.

You can find instructions for setting up the technology stack required for a DAO below.

Tech Stack

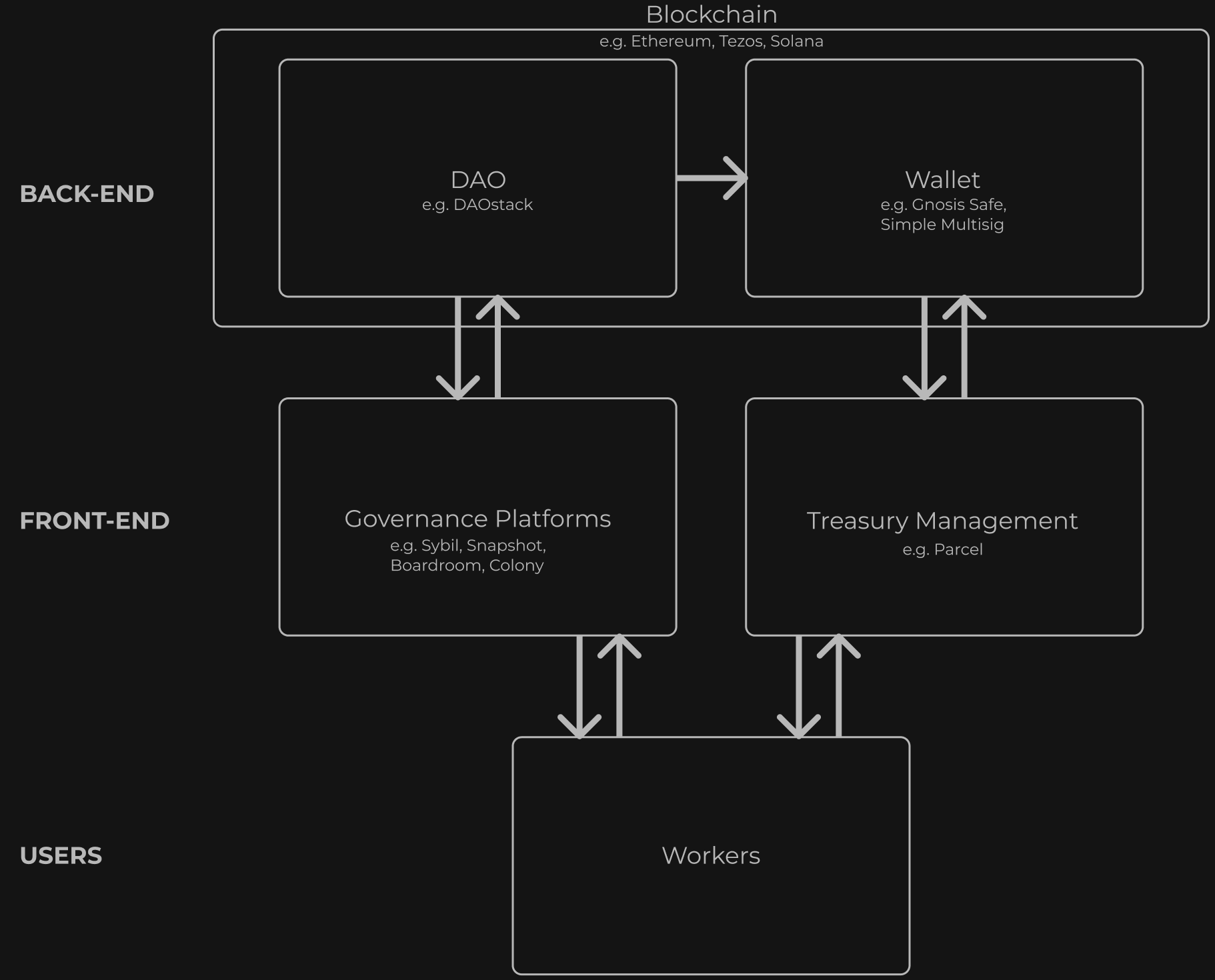

While you'll need to make some upfront technical investment to set up a DAO, the technology is advanced enough to be relatively user-friendly. You can assemble a simple stack of widely employed and well-tested consumer products to handle the blockchain back-end, governance, and treasury management.

In short: a blockchain is the platform that executes the smart contracts (simple algorithms encoding business logic) powering your operations. You store your company's assets as cryptocurrency in a shared wallet; treasury management products make it easier to handle this process. And your company makes decisions about who is allowed to move that money by voting on the blockchain; governance platforms make this process simpler.

Blockchain

Creating a DAO on the Ethereum blockchain using DAOstack

To start, you'll need to pick a blockchain technology to use as your back-end and create a DAO. Some popular examples are Ethereum, Tezos, and Solana. You can find a sample guide to creating a DAO on one of these platforms, using an open-source interface like DAOstack, here. The only prerequisite is to set up a shared wallet to hold company funds; see Treasury Management below for more information. Be sure that each of your workers has their own cryptocurrency wallet, like Coinbase or MEW. This will allow them to receive the tokens that give them voting rights in the company. From there, you just need to create the DAO and then distribute a single token to each person, using the process laid out in the guide linked above.

Governance

Using the Boardroom dashboard to view voters and proposals in a sample company

Once your core blockchain back-end is in place, you may want to use a few front-end tools to make day-to-day governance easier. A dashboard like Sybil can allow you to easily view who has voting power, and it gives employees the ability to delegate their votes to leaders they support. For quick surveys, something like Snapshot can be used to poll employees without requiring actual votes submitted on the blockchain. Finally, if you'd like, you can use a more elaborate collaboration tool, like Boardroom or Colony, that facilitates more in-depth discussion and decisionmaking.

Treasury Management

Viewing assets and transaction history for a sample company using Gnosis Safe

Along with governance, the second big function of a DAO is to control the company's funds, gating access to them on democratic approval. You should be especially careful in setting this up, as your organization's money could be irretrievably stolen or lost if you don't follow secure best practices. Be sure to consult with someone who has a technical background in this area. At a minimum, it's very important to keep your private key (usually a string of 12 words) completely safe and secret; ideally, you should also issue private keys to multiple trusted collaborators, in case any one is compromised. More information can be found here.

You'll need to hold your funds in a multisig wallet, like Gnosis Safe or Simple Multisig, which guarantees that transactions are made through democratic processes. You can use an interface layer on top of this, like Parcel, which makes it easy to manage the most important transactions on an ongoing basis.

This guide for founders was created by Trevor Pels in collaboration with the Aspen Tech Policy Hub. Trevor has founded a Y Combinator-backed start-up and worked as a product manager at Google, Facebook, Pinterest, and Lyft.